Background

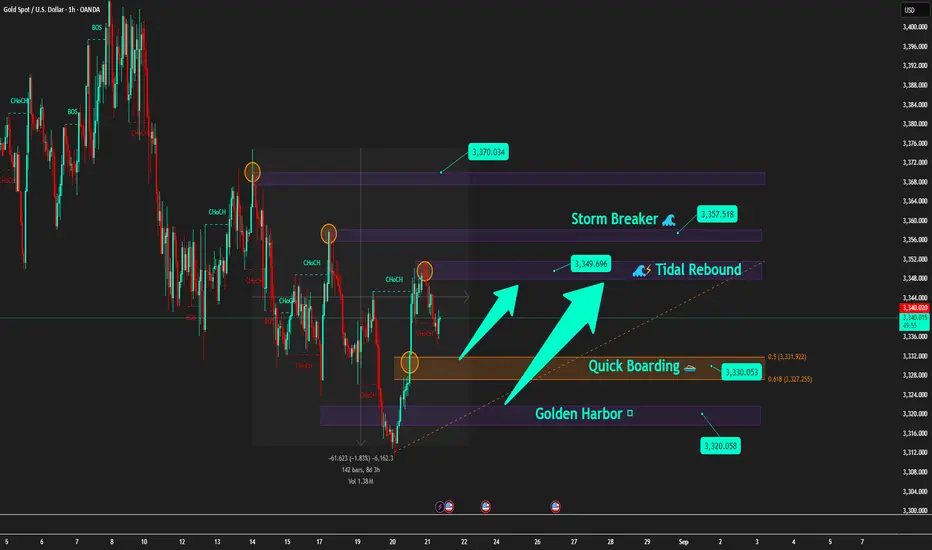

After the early morning FOMC session, Gold is showing signs of a sell-side pullback to gain momentum.

On higher timeframes (H4–D1), the structure remains bearish with lower highs.

However, consistent buying pressure around 3320 – 3330 keeps this zone as the key battlefield.

🪙 Key Levels Today

🔹 Storm Breaker 🌊 (Sell Zone 3357 – 3355)

SL: 3362

TP: 3350 → 3345 → 3340 → 33xx

🔹 Tidal Rebound 🌊⚡ (Sell Scalp 3349 – 3347)

SL: 3353

TP: 3345 → 3340 → 3335 → 33xx

🔹 Quick Boarding 🚤 (Buy Scalp 3330 – 3328)

SL: 3322

TP: 3335 → 3337 → 3339 → 3341

🔹 Golden Harbor 🏝️ (Buy Zone 3320)

SL: 3313

TP: 3325 → 3330 → extend further

📌 Trading Scenarios

After FOMC, the market may show rebound waves.

During Asia–Europe, price may consolidate between 3345 – 3357.

If price tests Storm Breaker 🌊 → Prioritise Sell setups in line with the main bearish trend.

If price drops to Quick Boarding 🚤 or Golden Harbor 🏝️ → Short-term Buy scalps on pullback moves.

📰 Market Context

FED remains dovish leaning, with high probability of a rate cut in September (~82%, CME FedWatch).

Geopolitical variables (Trump–Putin, Ukraine) remain unpredictable and may spark sudden volatility.

⚓ Captain’s Note

"Let Storm Breaker 🌊 test the buyers’ strength. Those who board at Golden Harbor 🏝️ will be lifted by the waves, but those who drift into the storm will soon feel the sea’s fury."

After the early morning FOMC session, Gold is showing signs of a sell-side pullback to gain momentum.

On higher timeframes (H4–D1), the structure remains bearish with lower highs.

However, consistent buying pressure around 3320 – 3330 keeps this zone as the key battlefield.

🪙 Key Levels Today

🔹 Storm Breaker 🌊 (Sell Zone 3357 – 3355)

SL: 3362

TP: 3350 → 3345 → 3340 → 33xx

🔹 Tidal Rebound 🌊⚡ (Sell Scalp 3349 – 3347)

SL: 3353

TP: 3345 → 3340 → 3335 → 33xx

🔹 Quick Boarding 🚤 (Buy Scalp 3330 – 3328)

SL: 3322

TP: 3335 → 3337 → 3339 → 3341

🔹 Golden Harbor 🏝️ (Buy Zone 3320)

SL: 3313

TP: 3325 → 3330 → extend further

📌 Trading Scenarios

After FOMC, the market may show rebound waves.

During Asia–Europe, price may consolidate between 3345 – 3357.

If price tests Storm Breaker 🌊 → Prioritise Sell setups in line with the main bearish trend.

If price drops to Quick Boarding 🚤 or Golden Harbor 🏝️ → Short-term Buy scalps on pullback moves.

📰 Market Context

FED remains dovish leaning, with high probability of a rate cut in September (~82%, CME FedWatch).

Geopolitical variables (Trump–Putin, Ukraine) remain unpredictable and may spark sudden volatility.

⚓ Captain’s Note

"Let Storm Breaker 🌊 test the buyers’ strength. Those who board at Golden Harbor 🏝️ will be lifted by the waves, but those who drift into the storm will soon feel the sea’s fury."

Join Real - Time Trade Post: t.me/+hdUNYZejfMo1ZWQ1

🔥 3 - 4 DAILY TRADE

🔥 15 - 20 SCALPING SIGNALS

🔥 Real - Time Proceed Orders

🔥 3 - 4 DAILY TRADE

🔥 15 - 20 SCALPING SIGNALS

🔥 Real - Time Proceed Orders

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.

Join Real - Time Trade Post: t.me/+hdUNYZejfMo1ZWQ1

🔥 3 - 4 DAILY TRADE

🔥 15 - 20 SCALPING SIGNALS

🔥 Real - Time Proceed Orders

🔥 3 - 4 DAILY TRADE

🔥 15 - 20 SCALPING SIGNALS

🔥 Real - Time Proceed Orders

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.