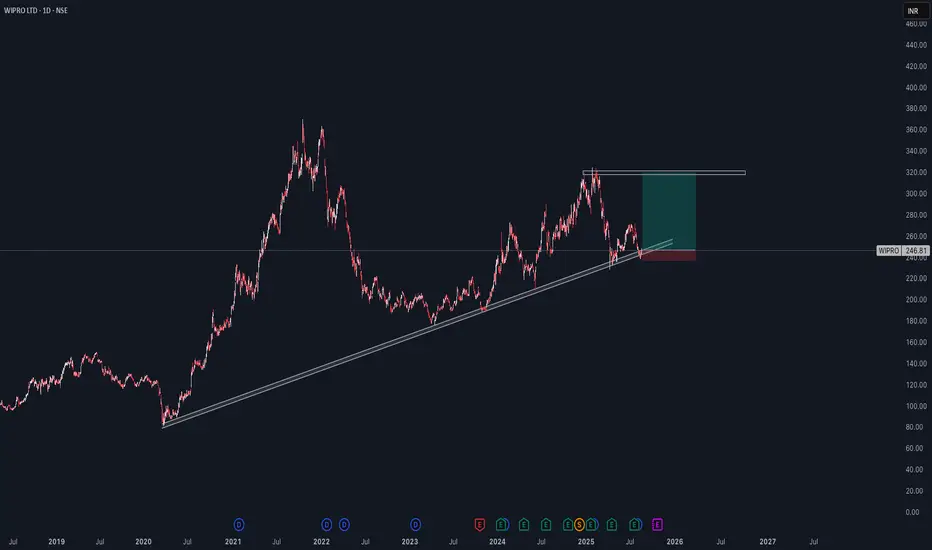

Wipro has been respecting a long-term trendline since 2020.

Price recently bounced from this trendline support near ₹240, showing strong buying interest.

The current structure suggests a possible trend continuation towards the higher resistance zone.

Trade Setup

Entry Zone: Around ₹245–250 (near trendline support)

Stop Loss: Below ₹230 (trendline breakdown level)

Target: ₹320 (previous supply zone / resistance level)

This gives a risk-to-reward ratio of approx. 1:3, which is favorable.

🔍 Technical Factors Supporting Bullish View

Price is consolidating above the long-term support trendline.

Multiple rejections from the downside show strong demand zone near ₹240.

If the momentum continues, buyers may push price towards the ₹320 resistance area.

⚠️ Risk Management

A daily close below ₹230 will invalidate this setup.

This is a positional swing trade, so patience is required.

Price recently bounced from this trendline support near ₹240, showing strong buying interest.

The current structure suggests a possible trend continuation towards the higher resistance zone.

Trade Setup

Entry Zone: Around ₹245–250 (near trendline support)

Stop Loss: Below ₹230 (trendline breakdown level)

Target: ₹320 (previous supply zone / resistance level)

This gives a risk-to-reward ratio of approx. 1:3, which is favorable.

🔍 Technical Factors Supporting Bullish View

Price is consolidating above the long-term support trendline.

Multiple rejections from the downside show strong demand zone near ₹240.

If the momentum continues, buyers may push price towards the ₹320 resistance area.

⚠️ Risk Management

A daily close below ₹230 will invalidate this setup.

This is a positional swing trade, so patience is required.

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.