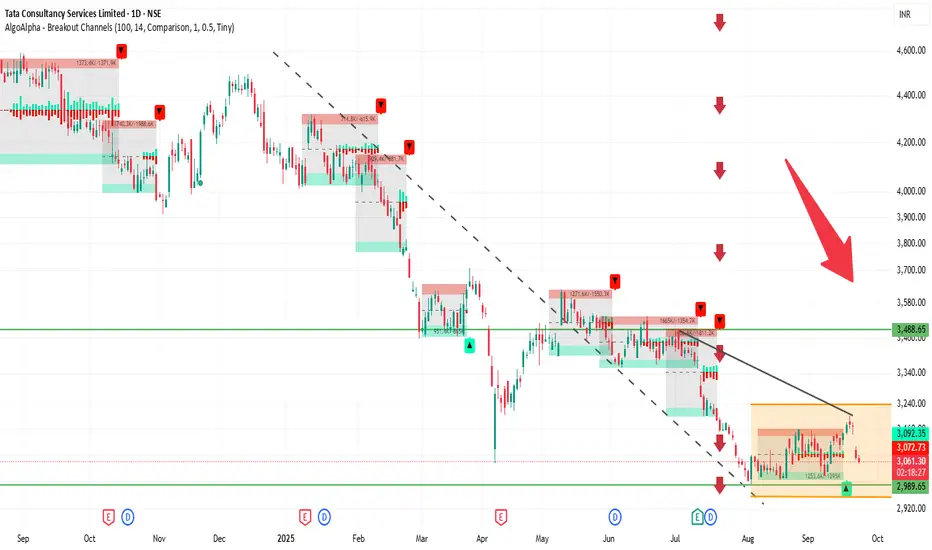

📍 Current Price & Range

Current price: ₹3,063.80

Day’s High / Low: ₹3,106.90 / ₹3,052.00

52-week High / Low: ₹4,494.90 / ₹2,991.60

🔍 Key Levels

Immediate resistance: ₹3,100–₹3,110

Next resistance: ₹3,200–₹3,250

Immediate support: ₹3,050–₹3,060

Psychological / strong support: ₹3,000

📊 Indicators & Momentum

Price is just below near-term resistance, showing hesitation.

Short-term trend is neutral to slightly bearish; momentum is weak.

RSI and MACD suggest neutral to weak momentum, no strong reversal yet.

Stock is trading well below its 52-week high, indicating it has already corrected significantly.

🔮 Possible Scenarios

Bullish breakout → Sustaining above ₹3,110 could push price toward ₹3,200–₹3,250.

Sideways / consolidation → Likely to trade between ₹3,050–₹3,110 if no strong catalyst.

Bearish pullback → Breaking below ₹3,050 may take price toward ₹3,000, and further down to ₹2,950–₹2,900 if weakness continues.

👉 Outlook: At the current level (₹3,073.80), TCS is in a neutral zone. The next directional move depends on either a breakout above resistance or a fall below support.

Current price: ₹3,063.80

Day’s High / Low: ₹3,106.90 / ₹3,052.00

52-week High / Low: ₹4,494.90 / ₹2,991.60

🔍 Key Levels

Immediate resistance: ₹3,100–₹3,110

Next resistance: ₹3,200–₹3,250

Immediate support: ₹3,050–₹3,060

Psychological / strong support: ₹3,000

📊 Indicators & Momentum

Price is just below near-term resistance, showing hesitation.

Short-term trend is neutral to slightly bearish; momentum is weak.

RSI and MACD suggest neutral to weak momentum, no strong reversal yet.

Stock is trading well below its 52-week high, indicating it has already corrected significantly.

🔮 Possible Scenarios

Bullish breakout → Sustaining above ₹3,110 could push price toward ₹3,200–₹3,250.

Sideways / consolidation → Likely to trade between ₹3,050–₹3,110 if no strong catalyst.

Bearish pullback → Breaking below ₹3,050 may take price toward ₹3,000, and further down to ₹2,950–₹2,900 if weakness continues.

👉 Outlook: At the current level (₹3,073.80), TCS is in a neutral zone. The next directional move depends on either a breakout above resistance or a fall below support.

Publicações relacionadas

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Publicações relacionadas

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.