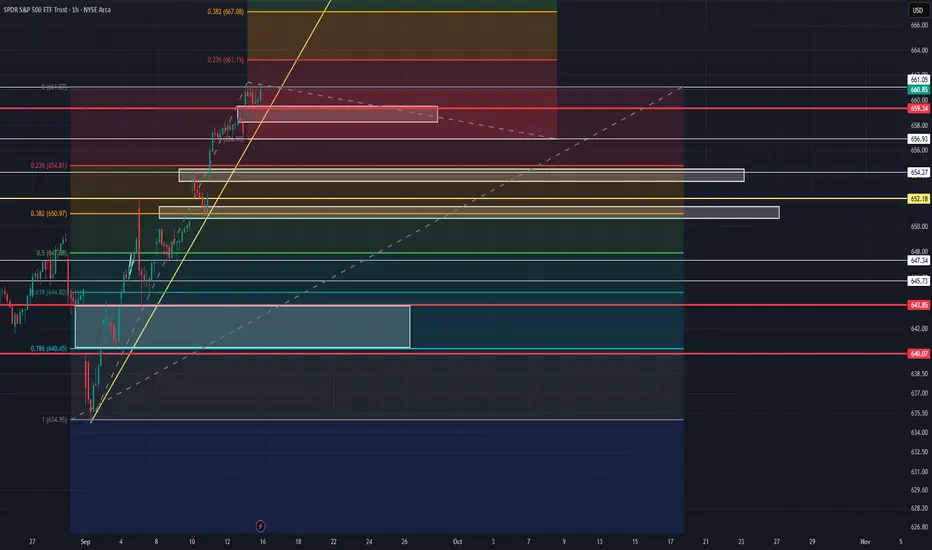

There are some key levels on  SPY i'm marking for the rest of the week. I still feel more bearish to rate cuts and post-rate cut announcement. There has been some strong upward pressure in the last week that it seems a bit irrational that we will not hit some cool off somewhere for an unknown period of time. There are some fib extension levels I marked for possible support/ resistance. Namely, 663.19 at the .236 and 667.08 at the .382. There are points above that as well marked. For support I have 654.81 and 650.97 which both lines up well with price action support/ resistance. if we break the more macro golden trendline I will be looking to leverage into a short position to a possible profit box on the downside towards some of these levels.

SPY i'm marking for the rest of the week. I still feel more bearish to rate cuts and post-rate cut announcement. There has been some strong upward pressure in the last week that it seems a bit irrational that we will not hit some cool off somewhere for an unknown period of time. There are some fib extension levels I marked for possible support/ resistance. Namely, 663.19 at the .236 and 667.08 at the .382. There are points above that as well marked. For support I have 654.81 and 650.97 which both lines up well with price action support/ resistance. if we break the more macro golden trendline I will be looking to leverage into a short position to a possible profit box on the downside towards some of these levels.

Rate cuts are ALREADY priced in, again, but anything that comes out that shifts our forward-looking projections could move price now. ie. future rate cuts, hawkish, dovishness etc.

Either way technicals still want cooling off but due to heavy bear pressure and this expectation being widespread we will see shorts getting squeezed a bit and price moving erratically at times to the upside (as we have ben).

Rate cuts are ALREADY priced in, again, but anything that comes out that shifts our forward-looking projections could move price now. ie. future rate cuts, hawkish, dovishness etc.

Either way technicals still want cooling off but due to heavy bear pressure and this expectation being widespread we will see shorts getting squeezed a bit and price moving erratically at times to the upside (as we have ben).

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.