Viés de alta

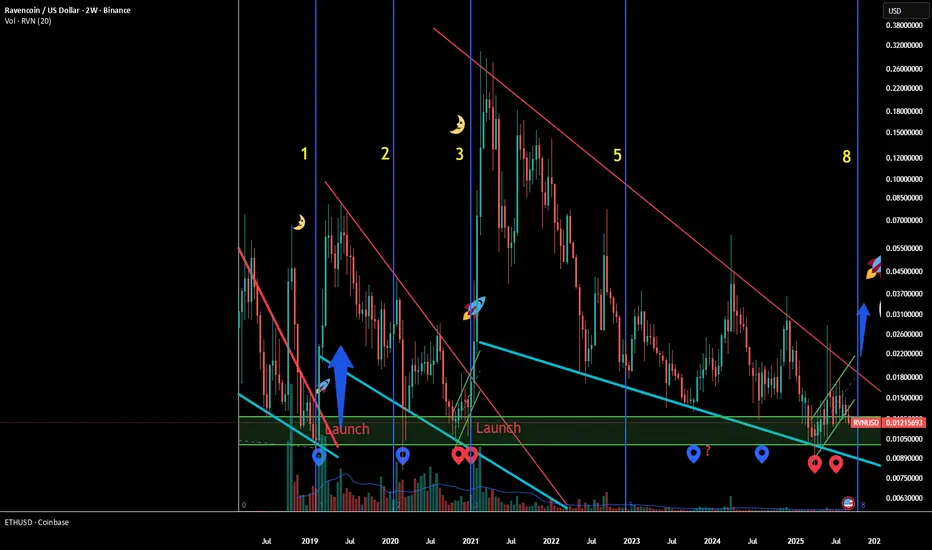

Ravencoin – Fibonacci Timezones: Next Moon End October 2025

https://www.tradingview.com/x/0Np0lrx6/

In short:

RVN’s breakouts lined up with Fibonacci time counts before.

Zone 1 → 2019 breakout.

Zone 3 → 2021 breakout.

Zone 8 → Oct 27, 2025?

If history rhymes, Ravencoin may be preparing its next moonshot right on schedule. 🚀

Ravencoin’s launchpads have followed a surprising Fibonacci rhythm.

⏳ The Time Structure

Zone 1 (2018–2019): From genesis until the bar just before the first breakout (Feb 2019).

Zone 2: Skipped.

Zone 3 (2020–2021): From bottoming until Jan 2021 — again, the bar just before breakout.

Zone 5: Skipped.

Zone 8 (2025): If the same rhythm holds, we are now approaching the next critical launchpad.

📌 By extrapolation, the Fibonacci sequence (1–2–3–5–8) suggests the next breakout window opens around 27 October 2025.

🧩 Why it matters

RVN’s history shows not just price fractals, but time fractals.

Each parabola was preceded by a Fibonacci-timed compression phase.

Skipping intermediate numbers (2, 5) makes the hits at 1, 3, and now 8 stand out even more.

🎯 Projection

Breakout could ignite in late October 2025.

Potential parabola similar to 2019 and 2021 cycles.

Target range: $0.25 → $0.50 if structure repeats.

📉 Bearish gift scenario

The current chart still carries a bearish bias.

A dip to $0.010–$0.009 cannot be excluded.

Instead of invalidating the setup, such a move would act as a final spring.

For long-term holders this is a gift — a last clean add opportunity before liftoff.

📚 Educational sidebar: Why Fibonacci often aligns with market cycles

The Fibonacci sequence (1, 2, 3, 5, 8, 13…) is not mystical — it’s structural.

Nature & growth: Plants, shells, galaxies, all grow in Fibonacci ratios.

Human behavior: Financial markets are driven by collective psychology. Fear, greed, and crowd timing often cluster around these proportions.

Markets: Traders unknowingly reinforce these rhythms by using Fibonacci retracements, extensions, and time zones.

👉 The result? Market cycles often “breathe” in Fibonacci counts — not perfectly, but frequently enough to create repeating patterns.

In short:

RVN’s breakouts lined up with Fibonacci time counts before.

Zone 1 → 2019 breakout.

Zone 3 → 2021 breakout.

Zone 8 → Oct 27, 2025?

If history rhymes, Ravencoin may be preparing its next moonshot right on schedule. 🚀

Ravencoin’s launchpads have followed a surprising Fibonacci rhythm.

⏳ The Time Structure

Zone 1 (2018–2019): From genesis until the bar just before the first breakout (Feb 2019).

Zone 2: Skipped.

Zone 3 (2020–2021): From bottoming until Jan 2021 — again, the bar just before breakout.

Zone 5: Skipped.

Zone 8 (2025): If the same rhythm holds, we are now approaching the next critical launchpad.

📌 By extrapolation, the Fibonacci sequence (1–2–3–5–8) suggests the next breakout window opens around 27 October 2025.

🧩 Why it matters

RVN’s history shows not just price fractals, but time fractals.

Each parabola was preceded by a Fibonacci-timed compression phase.

Skipping intermediate numbers (2, 5) makes the hits at 1, 3, and now 8 stand out even more.

🎯 Projection

Breakout could ignite in late October 2025.

Potential parabola similar to 2019 and 2021 cycles.

Target range: $0.25 → $0.50 if structure repeats.

📉 Bearish gift scenario

The current chart still carries a bearish bias.

A dip to $0.010–$0.009 cannot be excluded.

Instead of invalidating the setup, such a move would act as a final spring.

For long-term holders this is a gift — a last clean add opportunity before liftoff.

📚 Educational sidebar: Why Fibonacci often aligns with market cycles

The Fibonacci sequence (1, 2, 3, 5, 8, 13…) is not mystical — it’s structural.

Nature & growth: Plants, shells, galaxies, all grow in Fibonacci ratios.

Human behavior: Financial markets are driven by collective psychology. Fear, greed, and crowd timing often cluster around these proportions.

Markets: Traders unknowingly reinforce these rhythms by using Fibonacci retracements, extensions, and time zones.

👉 The result? Market cycles often “breathe” in Fibonacci counts — not perfectly, but frequently enough to create repeating patterns.

Publicações relacionadas

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.

Publicações relacionadas

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.