QCOM: Exploring Potential 30% Upside in AI Chip Contender Amid Data Center Expansion – SWOT and Intrinsic Value Insights

📊 Introduction

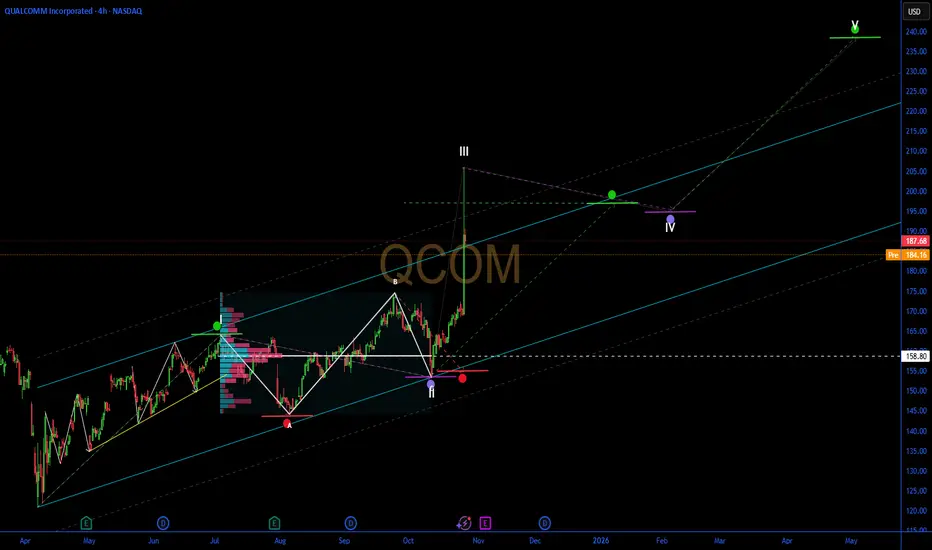

As of October 28, 2025, QUALCOMM Incorporated (QCOM) is experiencing post-announcement volatility following an 11% surge in the prior session, trading around $185 in pre-market after closing at $187.68. This movement stems from the launch of new AI accelerator chips aimed at competing in data centers, amid a broader tech rally driven by $500B in projected AI infrastructure spending and Fed rate stability at 4.75%. Sector dynamics reflect intensified competition in semiconductors, with NVIDIA and AMD also advancing, though macroeconomic factors like easing U.S.-China trade talks support chip demand, countered by ongoing export restrictions and supply chain inflation.

🔍 SWOT Analysis

**Strengths 💪**: Qualcomm holds a commanding position in mobile chipsets with over 40% market share, bolstered by TTM revenue of $43.26B and net income of $11.57B. Robust financials include a 44.62% return on equity and quarterly revenue growth of 10.30% yoy, driven by diversified segments like automotive (up 20% yoy). Low beta of 1.23 indicates relative stability, with partnerships in 5G and IoT enhancing ecosystem strength.

**Weaknesses ⚠️**: Debt-to-equity at 54.35% signals moderate leverage, potentially vulnerable in high-interest environments. Dependence on China for ~60% of revenue exposes risks from geopolitical tensions, while R&D costs (22% of revenue) could strain margins if AI adoption slows. Historical patent disputes add to operational challenges.

**Opportunities 🌟**: The AI data center push, with new chips targeting inference markets, aligns with a $200B+ opportunity by 2027, per industry forecasts. Growth in edge AI and automotive semiconductors, backed by analyst EPS projections rising to $12.10 for 2026, supports valuation re-rating. Expansion into PCs and servers via Snapdragon platforms could capture 15-20% share from Intel.

**Threats 🚩**: Fierce competition from NVIDIA's Blackwell and AMD's MI series threatens market erosion, with potential antitrust probes in the EU. Regulatory hurdles, such as U.S. export bans impacting 15-20% of sales, and broader sector volatility from tariff risks pose downside. Economic slowdowns may defer enterprise capex.

💰 Intrinsic Value Calculation

Applying a value investing method for tech stocks, we calculate intrinsic value using a weighted blend of book value and earnings multiples, with a 20% margin of safety for cyclical risks. Inputs from filings: Book value per share $25.10, TTM EPS $10.36, assumed growth rate 10% (blending current 16.37% and next-year 1.71% projections).

Formula: Intrinsic Value = (Book Value per Share * Weight) + (EPS * Growth Multiplier)

- Weight for book value: 0.3 (asset-intensive adjustments)

- Growth Multiplier: 28.5 (Graham-inspired: 8.5 + 2*10)

Calculation:

(25.10 * 0.3) + (10.36 * 28.5) = 7.53 + 295.26 = 302.79

Apply 20% margin of safety: 302.79 * 0.8 ≈ $242.23

At current price ~$185, QCOM appears undervalued by ~24-31% (upside to $242 fair value, aligned with forward P/E of 13.95 and comparables). Debt flags are minor at 54%, with sustainability tied to EPS growth above 10%. 📈 Undervalued.

📈 Entry Strategy Insights

Institutional methods target support zones near $180-182 (near 50-day SMA) for unleveraged, long-term entries using dollar-cost averaging (DCA). Scale in on 4-7% dips, employing non-repainting volume-based signals to verify momentum shifts. Effective for 10-15% position accumulation over 2-4 months, with breakout targets above $190 for phased exits. 🚀 Spot zones.

⚠️ Risk Management

Restrict sizing to 1-5% of portfolio to handle sector swings, diversifying across tech subsectors and defensives. Use trailing stops 7-10% below entry (e.g., $170) and favor long-term holds if ROE sustains, monitoring earnings reports and trade policy. Caution on 10-20% drawdowns from competitive news.

🔚 Conclusion

Qualcomm's AI diversification, solid fundamentals, and undervalued profile amid tech momentum indicate potential to $242+, with safety buffers. Key takeaways: Track AI adoption for earnings uplift, independently validate growth estimates.

This is educational content only; not financial advice. Always conduct your own due diligence.

📊 Introduction

As of October 28, 2025, QUALCOMM Incorporated (QCOM) is experiencing post-announcement volatility following an 11% surge in the prior session, trading around $185 in pre-market after closing at $187.68. This movement stems from the launch of new AI accelerator chips aimed at competing in data centers, amid a broader tech rally driven by $500B in projected AI infrastructure spending and Fed rate stability at 4.75%. Sector dynamics reflect intensified competition in semiconductors, with NVIDIA and AMD also advancing, though macroeconomic factors like easing U.S.-China trade talks support chip demand, countered by ongoing export restrictions and supply chain inflation.

🔍 SWOT Analysis

**Strengths 💪**: Qualcomm holds a commanding position in mobile chipsets with over 40% market share, bolstered by TTM revenue of $43.26B and net income of $11.57B. Robust financials include a 44.62% return on equity and quarterly revenue growth of 10.30% yoy, driven by diversified segments like automotive (up 20% yoy). Low beta of 1.23 indicates relative stability, with partnerships in 5G and IoT enhancing ecosystem strength.

**Weaknesses ⚠️**: Debt-to-equity at 54.35% signals moderate leverage, potentially vulnerable in high-interest environments. Dependence on China for ~60% of revenue exposes risks from geopolitical tensions, while R&D costs (22% of revenue) could strain margins if AI adoption slows. Historical patent disputes add to operational challenges.

**Opportunities 🌟**: The AI data center push, with new chips targeting inference markets, aligns with a $200B+ opportunity by 2027, per industry forecasts. Growth in edge AI and automotive semiconductors, backed by analyst EPS projections rising to $12.10 for 2026, supports valuation re-rating. Expansion into PCs and servers via Snapdragon platforms could capture 15-20% share from Intel.

**Threats 🚩**: Fierce competition from NVIDIA's Blackwell and AMD's MI series threatens market erosion, with potential antitrust probes in the EU. Regulatory hurdles, such as U.S. export bans impacting 15-20% of sales, and broader sector volatility from tariff risks pose downside. Economic slowdowns may defer enterprise capex.

💰 Intrinsic Value Calculation

Applying a value investing method for tech stocks, we calculate intrinsic value using a weighted blend of book value and earnings multiples, with a 20% margin of safety for cyclical risks. Inputs from filings: Book value per share $25.10, TTM EPS $10.36, assumed growth rate 10% (blending current 16.37% and next-year 1.71% projections).

Formula: Intrinsic Value = (Book Value per Share * Weight) + (EPS * Growth Multiplier)

- Weight for book value: 0.3 (asset-intensive adjustments)

- Growth Multiplier: 28.5 (Graham-inspired: 8.5 + 2*10)

Calculation:

(25.10 * 0.3) + (10.36 * 28.5) = 7.53 + 295.26 = 302.79

Apply 20% margin of safety: 302.79 * 0.8 ≈ $242.23

At current price ~$185, QCOM appears undervalued by ~24-31% (upside to $242 fair value, aligned with forward P/E of 13.95 and comparables). Debt flags are minor at 54%, with sustainability tied to EPS growth above 10%. 📈 Undervalued.

📈 Entry Strategy Insights

Institutional methods target support zones near $180-182 (near 50-day SMA) for unleveraged, long-term entries using dollar-cost averaging (DCA). Scale in on 4-7% dips, employing non-repainting volume-based signals to verify momentum shifts. Effective for 10-15% position accumulation over 2-4 months, with breakout targets above $190 for phased exits. 🚀 Spot zones.

⚠️ Risk Management

Restrict sizing to 1-5% of portfolio to handle sector swings, diversifying across tech subsectors and defensives. Use trailing stops 7-10% below entry (e.g., $170) and favor long-term holds if ROE sustains, monitoring earnings reports and trade policy. Caution on 10-20% drawdowns from competitive news.

🔚 Conclusion

Qualcomm's AI diversification, solid fundamentals, and undervalued profile amid tech momentum indicate potential to $242+, with safety buffers. Key takeaways: Track AI adoption for earnings uplift, independently validate growth estimates.

This is educational content only; not financial advice. Always conduct your own due diligence.

⚡️ Request a trial or subscribe to our premium🛠️tools at ➡️DCAlpha.net

All scripts & content provided by DCAChampion are for informational & educational purposes only.

All scripts & content provided by DCAChampion are for informational & educational purposes only.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

⚡️ Request a trial or subscribe to our premium🛠️tools at ➡️DCAlpha.net

All scripts & content provided by DCAChampion are for informational & educational purposes only.

All scripts & content provided by DCAChampion are for informational & educational purposes only.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.