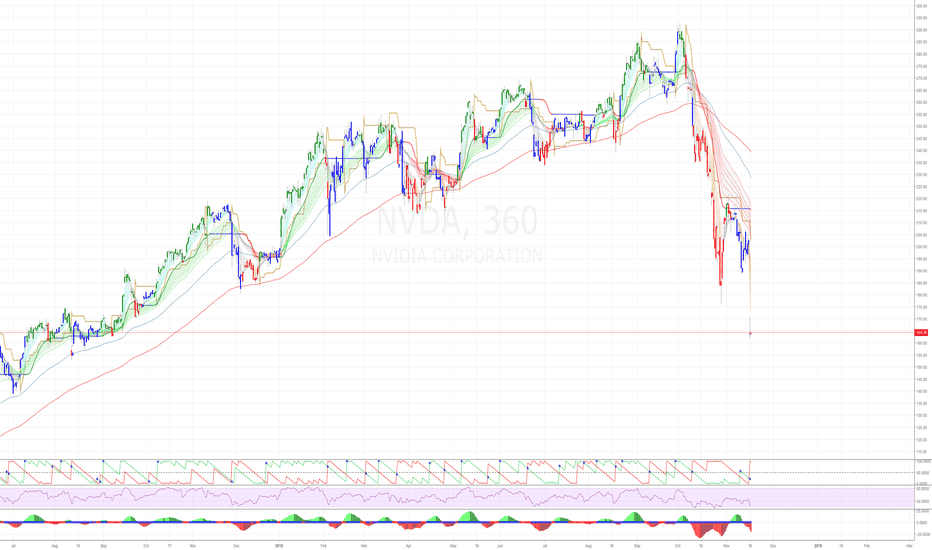

In my previous screencast of 17th November, below all this text, is the story of someone (not from Tradingview) messaging me to ask if NVDA was good to buy. They were disappointed when I simply said "No".

In the current screencast I follow up on how the FOMO bulls were punished for attempting to hunt a gap too early.

This screencast is not advice. I am not saying that NVDA will not rise again. The point of this video is solely about appreciating when not to go in. I'm not saying that now is a bad time or good time to enter long.

There are lessons in this:

1. If you're with the trend it can be your friend, else it's your enemy!

2. Avoid news and social media crowd sentiment.

3. Avoid gurus.

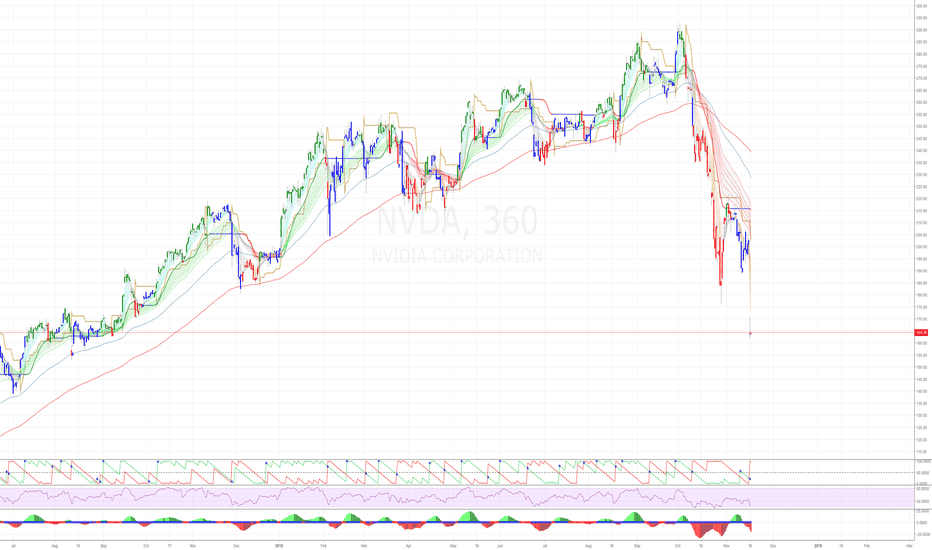

In the current screencast I follow up on how the FOMO bulls were punished for attempting to hunt a gap too early.

This screencast is not advice. I am not saying that NVDA will not rise again. The point of this video is solely about appreciating when not to go in. I'm not saying that now is a bad time or good time to enter long.

There are lessons in this:

1. If you're with the trend it can be your friend, else it's your enemy!

2. Avoid news and social media crowd sentiment.

3. Avoid gurus.

FED balance sheet 42% of GDP @ 2020-01-26. Does money have value anymore? [Different perspective on the virus youtu.be/NjTdvALChwk ]

Publicações relacionadas

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.

FED balance sheet 42% of GDP @ 2020-01-26. Does money have value anymore? [Different perspective on the virus youtu.be/NjTdvALChwk ]

Publicações relacionadas

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.