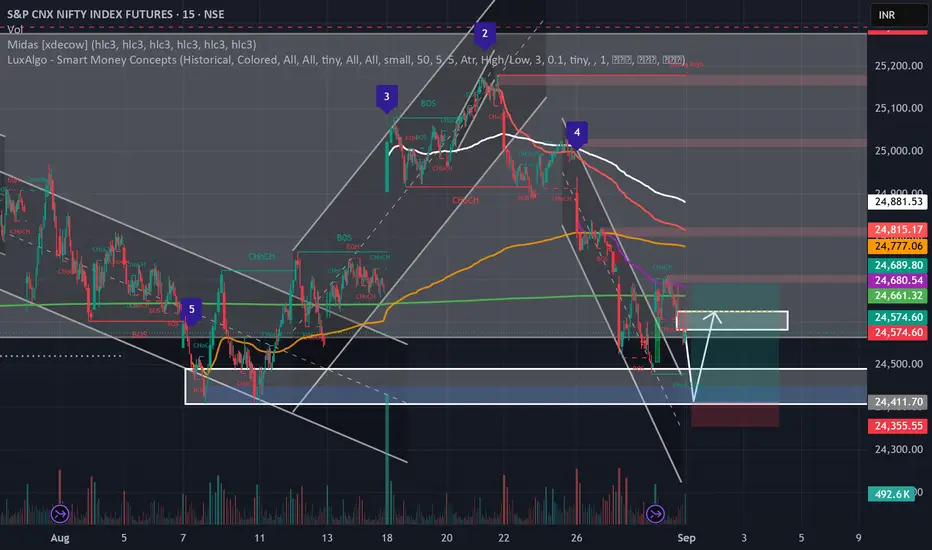

**📊 NIFTY FUTURES - Potential Bounce Setup from Key Confluence Zone**

**Key Technical Setup:**

• Long-term AVWAP anchored at 21,900 has turned flat, indicating equilibrium

• Multiple selling AVWAPs (red, white, yellow) are converging, suggesting exhaustion of selling pressure

• Market trading within broad consolidation range of 24,000 - 26,000

• Currently positioned at the lower end of this flat zone

**Critical Support Zone: 24,400 - 24,450**

• Strong order block identified in this zone

• Multiple technical confluences align at these levels

**Monday Market Dynamics:**

Mondays historically tend to create swing lows/highs, adding seasonal bias to our technical setup.

**Trade Strategy:**

🎯 **Long Setup:** Look for longs if market tests 24,400 zone and shows recovery

⏰ **Timing:** First hour often sees the low being tested with immediate recovery

🚨 **Risk Management:** Avoid getting trapped on the downside Monday morning

**Market Outlook:**

With selling pressure converging and key support holding, expecting potential bounce during the week. The confluence of technical levels, order flow, and seasonal patterns suggests a higher probability setup for upside participation.

**⚠️ Trade Plan:** Don't chase the downside - wait for the bounce setup to materialize.

---

*What are your thoughts on this confluence setup? Drop your views in the comments!*

Nota

it also looks like head n shoulders break down pattern but India vix is not suggesting any immediate break down as such .Nota

TGT seems to be achieved .we are at the upper end of the rangeAviso legal

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Aviso legal

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.