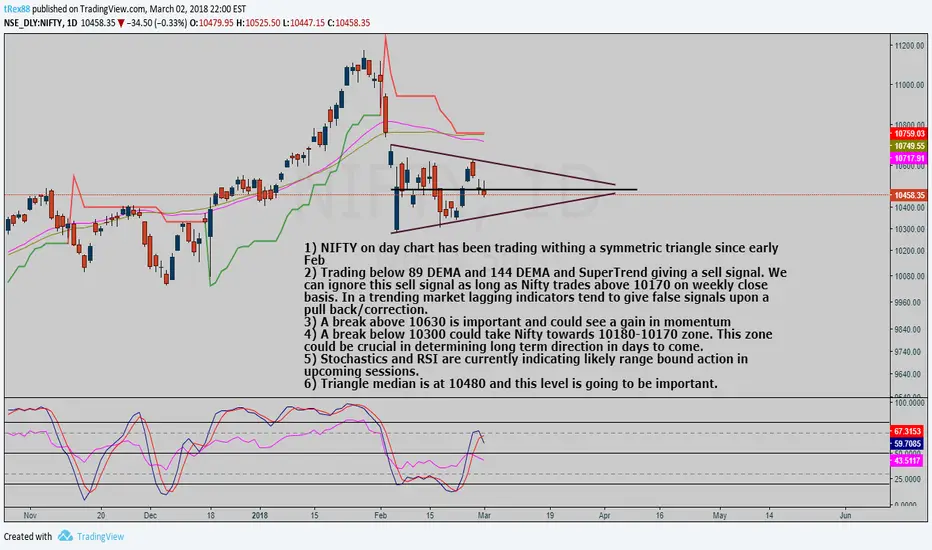

1) NIFTY on day chart has been trading withing a symmetric triangle since early Feb

2) Trading below 89 DEMA and 144 DEMA and SuperTrend giving a sell signal. We can ignore this sell signal as long as Nifty trades above 10170 on weekly close basis. In a trending market lagging indicators tend to give false signals upon a pull back/correction.

3) A break above 10630 is important and could see a gain in momentum

4) A break below 10300 could take Nifty towards 10180-10170 zone. This zone could be crucial in determining long term direction in days to come.

5) Stochastics and RSI are currently indicating likely range bound action in upcoming sessions.

6) Triangle median is at 10480 and this level is going to be important.

2) Trading below 89 DEMA and 144 DEMA and SuperTrend giving a sell signal. We can ignore this sell signal as long as Nifty trades above 10170 on weekly close basis. In a trending market lagging indicators tend to give false signals upon a pull back/correction.

3) A break above 10630 is important and could see a gain in momentum

4) A break below 10300 could take Nifty towards 10180-10170 zone. This zone could be crucial in determining long term direction in days to come.

5) Stochastics and RSI are currently indicating likely range bound action in upcoming sessions.

6) Triangle median is at 10480 and this level is going to be important.

Nota

Symmetric triangle as seen on hourly chartNota

Nifty appears to have taken bounce at the triangle bottom and now could move towards the median at 10480.It could face some resistance at 10430-10420 before touching the median

Nota

Nifty faced resistance at 10430-10420 and could not sustain. Hence moved it towards the triangle bottom. On hourly chart there was a strong fight and finally triangle bottom was broken. We can expect 10180 in upcoming trading session

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.