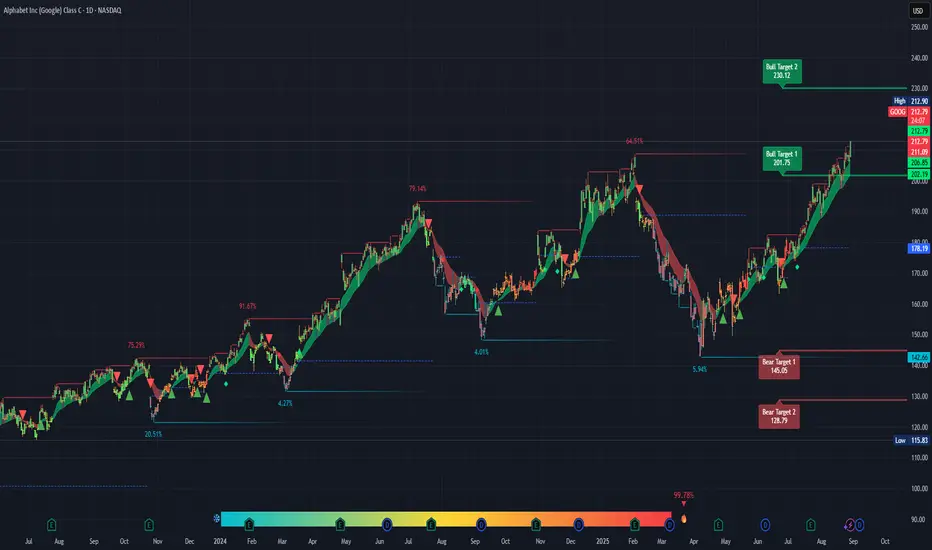

Strong Trend: Price has been pushing higher since April 2025, with higher highs and higher lows intact. The green zone shows momentum is with the bulls.

Breakout Attempt: You’re sitting near recent highs around 212.90, which shows buyers are in control. If it clears that resistance cleanly, Bull Target 1 (201.75) is already hit, and Target 2 (230.12) is in play.

Volume Uptick: Volume looks supportive of the breakout move (12.61M shown). More buyers stepping in usually confirms the move.

⚠️ Concerns (Why It Might Fail)

Overextended Run: The stock has already run ~40+% since April. Moves like this often see consolidation or pullbacks before the next leg.

Bear Targets Still in Play: If the breakout fails, your downside risk is real: 142.66 → 145.05 (Bear Target 1), and possibly 128.79 (Bear Target 2). That’s a nasty ~30–35% potential drop.

Resistance at 212.90: If it can’t close strong above here, you may get a short-term double top.

🎯 Cost vs. Benefit

Upside to Bull Target 2 (230.12): ~8% gain.

Downside to Bear Target 1 (145.05): ~32% risk.

Risk/Reward: About 1:4 against you right now unless you use a tight stop. That’s not attractive for a fresh entry.

🤔 Too Good to Be True Filter

“This chart looks like it’s going straight to 230” — probably not that easy. Expect chop and possible pullbacks around the 210–215 zone. If it does blast through with high volume, then you’ve got confirmation.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.