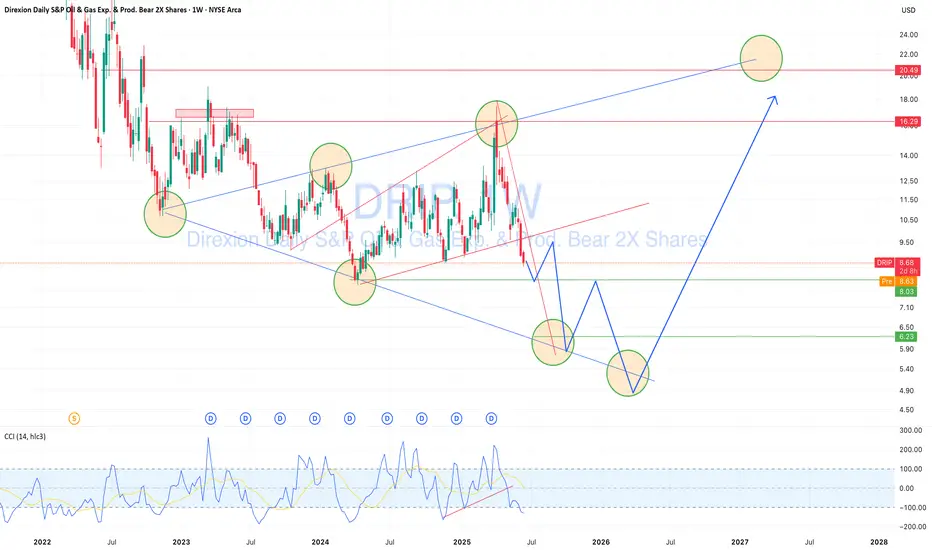

DRIP — Geopolitical Oil Risk Creates a Buying Opportunity

DRIP (inverse 2x ETF on US oil & gas exploration/production) is approaching a key technical support zone.

While oil may continue rising short term due to geopolitical tensions — especially US-Iran risks and Middle East instability — this short-term pressure could push DRIP lower toward the $5.00–6.00 area. That zone aligns with strong historical reversal points and trend support. From there, a rebound toward $12.00–20.00 is technically and fundamentally possible, offering 30–50%+ profit potential. I’m planning staged entries in the marked range, managing risk with awareness of commodity market volatility and global uncertainty.

While oil may continue rising short term due to geopolitical tensions — especially US-Iran risks and Middle East instability — this short-term pressure could push DRIP lower toward the $5.00–6.00 area. That zone aligns with strong historical reversal points and trend support. From there, a rebound toward $12.00–20.00 is technically and fundamentally possible, offering 30–50%+ profit potential. I’m planning staged entries in the marked range, managing risk with awareness of commodity market volatility and global uncertainty.

🔗 Сайт totoshkatrades.com

👨🎓 Наш телеграм t.me/totoshkatrading

🉐 Платформы linktr.ee/totoshka55

💬 Наши контакты @totoshkatips

👨🎓 Наш телеграм t.me/totoshkatrading

🉐 Платформы linktr.ee/totoshka55

💬 Наши контакты @totoshkatips

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.

🔗 Сайт totoshkatrades.com

👨🎓 Наш телеграм t.me/totoshkatrading

🉐 Платформы linktr.ee/totoshka55

💬 Наши контакты @totoshkatips

👨🎓 Наш телеграм t.me/totoshkatrading

🉐 Платформы linktr.ee/totoshka55

💬 Наши контакты @totoshkatips

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.