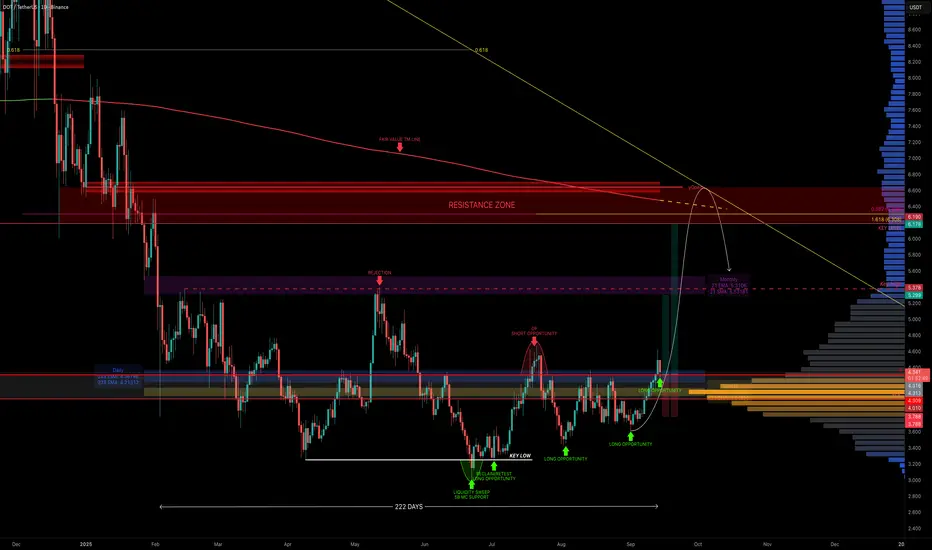

DOT has been in sideways chop for 222 days, but things are finally getting interesting. Price is now sitting above the yearly level ($4.309), the daily 233 EMA/SMA, and the weekly 21 EMA/SMA. Even better, it reclaimed the POC of the entire 222-day range.

Why $4 Is So Important

That’s a whole lot of support stacked at one zone.

Where It Gets Exciting (Targets)

First major target is the monthly 21 EMA/SMA ($5.3–$5.5), which also lines up with the range highs. That’s the first real test. The swing target zone sits around $6–$6.5, with multiple layers of confluence:

📌 This creates a solid resistance cluster between $6–$6.6, ideal for taking profits and potentially looking for shorts.

🟢 Long Trade Idea

Key Levels

🔍 Indicators used

➡️ Available for free. You can find it on my profile under “Scripts” and apply it directly to your charts for extra confluence when planning your trades.

_________________________________

💬 If you found this helpful, drop a like and comment!

Why $4 Is So Important

- Yearly level → $4.309

- Daily 233 EMA → $4.37 / Daily 233 SMA → $4.21

- Weekly 21 EMA → $4.15 / Weekly 21 SMA → $4.05

- POC of 222-day range → $4

- 0.618 Fib retracement (current move) → $4

That’s a whole lot of support stacked at one zone.

Where It Gets Exciting (Targets)

First major target is the monthly 21 EMA/SMA ($5.3–$5.5), which also lines up with the range highs. That’s the first real test. The swing target zone sits around $6–$6.5, with multiple layers of confluence:

- Key Level → ~$6

- Fair Value Trend Model Line → ~$6.5

- 0.382 Fib retracement of the downtrend → ~$6.19

- 0.618 Fib speed fan → ~$6.2 (October projection)

- 1.618 trend-based Fib extension → $6.308

- Market Cap Confluence: 10B market cap at $6.18

- Yearly Open: $6.642 → the overall target and an additional layer of resistance

📌 This creates a solid resistance cluster between $6–$6.6, ideal for taking profits and potentially looking for shorts.

🟢 Long Trade Idea

- Entry: Ladder longs from $4.36 down to $4

- Stop: Below $4 (clear invalidation)

- Take Profit: If $4 holds, DOT’s path is clear: first stop $5.3-$5.5, then $6.0–$6.6 as the macro target with the yearly open at $6.642 marking the final resistance.

Key Levels

- Support → $4.36–$4

- Resistance → $5.3–$5.5, then $6.2–$6.6 (10B market cap $6.18 + yearly open $6.642)

🔍 Indicators used

- LuxAlgo — Liquidity Sentiment Profile (Auto-Anchored)

- DriftLine — Pivot Open Zones [SiDec] → For identifying key yearly/monthly/weekly/daily opens that act as major S/R reference points

- Multi Timeframe 8x MA Support Resistance Zones [SiDec] → to identify support and resistance zones such as the monthly 21 EMA/SMA.

- Fair Value Trend Model [SiDec] → Calculates a regression-based fair value curve

➡️ Available for free. You can find it on my profile under “Scripts” and apply it directly to your charts for extra confluence when planning your trades.

_________________________________

💬 If you found this helpful, drop a like and comment!

Nota

DOT Update — Battling to Reclaim the Yearly LevelDOT lost the yearly level as support but quickly found footing at the 0.5 Fib retracement ($4.119) from the $3.6 swing low. As mentioned earlier in the comments, the $4.1 zone was the ideal long entry, backed by multiple layers of confluence:

→ 0.5 Fib retracement at $4.119

→ Weekly level at $4.11

→ Anchored VWAP from the $3.612 swing low aligning right on the weekly level

→ 0.618 Fib speed fan just below as extra support

Price has reacted well from this zone, but the current obstacle is the anchored VWAP from the $4.626 swing high, sitting close to the yearly level.

📌 For DOT to continue higher, it needs a clean break and retest of the yearly level to confirm bullish momentum.

🏆 Mastering Fibonacci for precision trading

🔹 Sharing high-probability trade setups

⚡ Unlock the power of technical analysis!

🔹 Sharing high-probability trade setups

⚡ Unlock the power of technical analysis!

Publicações relacionadas

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.

🏆 Mastering Fibonacci for precision trading

🔹 Sharing high-probability trade setups

⚡ Unlock the power of technical analysis!

🔹 Sharing high-probability trade setups

⚡ Unlock the power of technical analysis!

Publicações relacionadas

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.