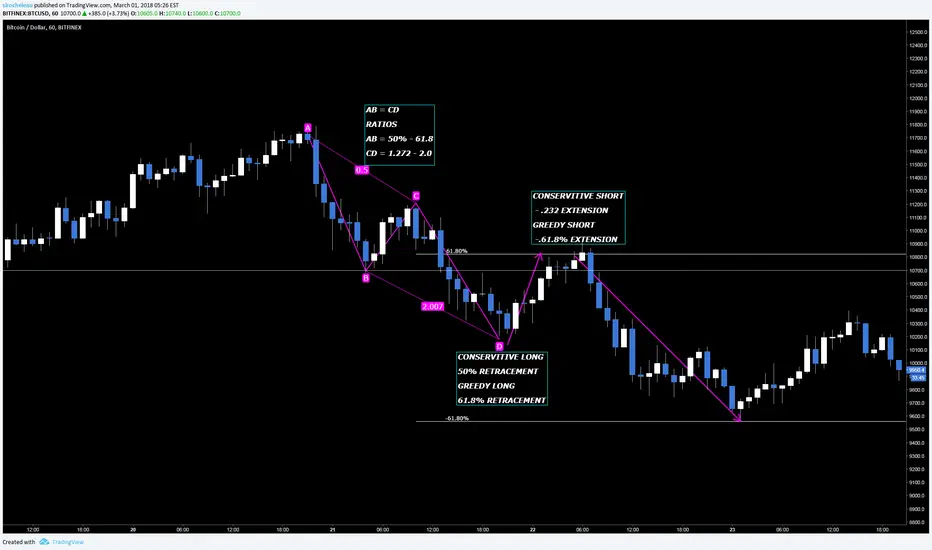

PART 1 AB =CD ( The Retrace )

You will find Harmonic patterns everywhere.. All you have to do is look..

Once you've established an AB=CD Pattern is close to being complete or has been completed it's game time.

In a down trend you will find Bullish AB = CD patterns. That's bc the market has moved down, over extended it'self momentarily and is ready for a retracement / correction. (does not mean trend is dead Which is where you make your second jack pot of the trade.)

I like to set realistic Targets or TPs which is why on my trades you will see my targets are more than likely going to be the 50% FIB retracement Level. ( The King FIB level )

That is where I take profit no matter what.

PART 2 AB = CD ( The Extension )

Once you establish a nice rejection at either the 50% or 61.8% FIBS It's time to short.

My past experience tells me to trade conservitively but to each their own. You are almost guarnteed going to hit the -.232 extension after every retracement.

The second most likely target is the -61.8% Extension as seen in this chart.

I always take profit at the -.232 extension after a 61.8 and 50% bounce.

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.