📅 BANK NIFTY Trading Plan – 20th May 2025

🕒 Timeframe: 15-Minute | 🎯 Strategy: Price Action + Reaction Zones + Risk Management Principles

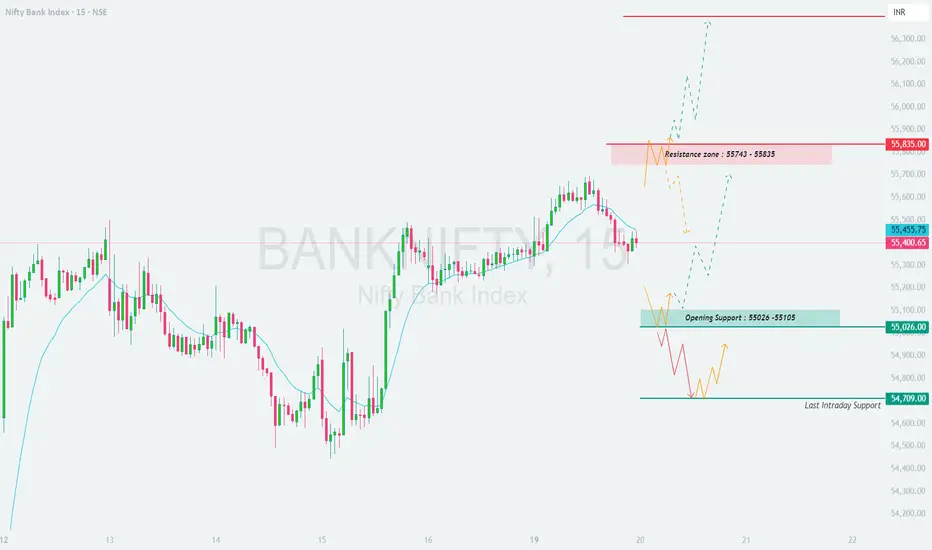

📌 Key Intraday Levels:

🔴 Resistance Zone: 55,743 – 55,835

🟦 Opening Support Zone: 55,026 – 55,105

🟫 Last Intraday Support: 54,709

📈 Scenario 1: GAP UP Opening (🔺 +200 points or more) – Opening Above 55,743

If Bank Nifty opens directly inside or above the resistance zone of 55,743–55,835, it's crucial not to chase the move blindly. This zone can act as a strong supply area where profit-booking or shorting by institutions may occur.

📌 Educational Tip: A gap-up into resistance isn’t a buy signal by default. It's a “wait & watch” zone. Let smart money reveal its hand.

⚖️ Scenario 2: FLAT Opening (Within ±100 points) – Between 55,300 – 55,500

A flat or minor gap opening inside the midpoint of the prior range creates a neutral setup, allowing for price discovery in either direction.

📌 Educational Tip: Flat opens are common traps for impatient traders. Observe the first move, then plan the second move — it’s often more rewarding.

📉 Scenario 3: GAP DOWN Opening (🔻 -200 points or more) – Below 55,026

A gap-down below the opening support range (55,026–55,105) creates a bearish sentiment, but it must be confirmed with price action.

📌 Educational Tip: Gap-downs into key support areas often fake breakdowns before a reversal. Only act when price confirms with conviction.

🛡️ Options Trading – Risk Management Tips:

✅ Define Maximum Risk: Only use capital you can afford to lose. Never go all-in on directional option trades.

✅ Avoid Illiquid Strikes: Stick to ATM/1-step ITM or OTM strikes with good liquidity to avoid slippage.

✅ Use Spreads to Your Advantage: Credit spreads (Bear Call, Bull Put) work well in rangebound days.

✅ Don’t Chase Premiums: Avoid overpaying for options after the move. Wait for cooling off or structure risk via spreads.

✅ Set SL on Premium Value: Instead of index, SL based on option premium value (e.g., 40–50% loss) improves consistency.

✅ Avoid Carrying Naked Trades Overnight: Especially on Fridays or before events. Use hedging (e.g., protective puts or calls).

📊 Summary & Action Plan:

🔼 Above 55,835: Bullish continuation zone → Target 56,000 – 56,200

🔄 Between 55,300 – 55,500: Neutral zone → Wait for breakout or breakdown

🔽 Below 55,026: Bearish sentiment → Watch for reversal at 54,709 or breakdown continuation

📌 Golden Rule: Let price show intent. Follow levels, not emotions. Never compromise on risk management.

📢 Disclaimer:

I am not a SEBI-registered analyst. The content above is purely for educational and informational purposes. Please do your own research or consult a registered financial advisor before taking any trading decisions.

🕒 Timeframe: 15-Minute | 🎯 Strategy: Price Action + Reaction Zones + Risk Management Principles

📌 Key Intraday Levels:

🔴 Resistance Zone: 55,743 – 55,835

🟦 Opening Support Zone: 55,026 – 55,105

🟫 Last Intraday Support: 54,709

📈 Scenario 1: GAP UP Opening (🔺 +200 points or more) – Opening Above 55,743

If Bank Nifty opens directly inside or above the resistance zone of 55,743–55,835, it's crucial not to chase the move blindly. This zone can act as a strong supply area where profit-booking or shorting by institutions may occur.

- []Wait for a clear 15-minute candle close above 55,835 with strong momentum and volume to confirm breakout strength.

[]Once confirmed, target upside zones like 56,000 → 56,200+ can be achievable in intraday.

[]However, if Bank Nifty opens in the resistance zone and shows rejection (e.g., long upper wicks, bearish candles), this becomes a high-probability short setup back toward 55,600 → 55,450.

[]Risk-to-reward is often unfavorable on immediate buying after a gap-up unless confirmation is present.

📌 Educational Tip: A gap-up into resistance isn’t a buy signal by default. It's a “wait & watch” zone. Let smart money reveal its hand.

⚖️ Scenario 2: FLAT Opening (Within ±100 points) – Between 55,300 – 55,500

A flat or minor gap opening inside the midpoint of the prior range creates a neutral setup, allowing for price discovery in either direction.

- []Avoid aggressive trades in the first 15–30 minutes. Wait for directional clarity.

[]A breakout above 55,743 with a strong candle can lead to an intraday up-move toward 55,835 → 56,000+.

[]On the downside, a break below 55,300 can drag the index toward 55,100 → 55,026.

[]Let price retest the support/resistance zone for safer risk-reward setups. - Consider using straddles or non-directional strategies if the index consolidates for 30–45 minutes with low volume.

📌 Educational Tip: Flat opens are common traps for impatient traders. Observe the first move, then plan the second move — it’s often more rewarding.

📉 Scenario 3: GAP DOWN Opening (🔻 -200 points or more) – Below 55,026

A gap-down below the opening support range (55,026–55,105) creates a bearish sentiment, but it must be confirmed with price action.

- []If price opens below 55,026 and sustains below 54,950, a fall toward 54,709 (last intraday support) is highly probable.

[]Break below 54,709 with volume opens the path to 54,500 → 54,350. Use this zone cautiously for fresh shorts only after confirmation.

[]Watch for possible bounce-back if price sharply reverses from 54,709 with a bullish pattern (like hammer or bullish engulfing). This could trigger a reversal toward 55,100+.

[]Avoid bottom-fishing in the first 15 minutes unless you see solid reversal candles with volume confirmation.

📌 Educational Tip: Gap-downs into key support areas often fake breakdowns before a reversal. Only act when price confirms with conviction.

🛡️ Options Trading – Risk Management Tips:

✅ Define Maximum Risk: Only use capital you can afford to lose. Never go all-in on directional option trades.

✅ Avoid Illiquid Strikes: Stick to ATM/1-step ITM or OTM strikes with good liquidity to avoid slippage.

✅ Use Spreads to Your Advantage: Credit spreads (Bear Call, Bull Put) work well in rangebound days.

✅ Don’t Chase Premiums: Avoid overpaying for options after the move. Wait for cooling off or structure risk via spreads.

✅ Set SL on Premium Value: Instead of index, SL based on option premium value (e.g., 40–50% loss) improves consistency.

✅ Avoid Carrying Naked Trades Overnight: Especially on Fridays or before events. Use hedging (e.g., protective puts or calls).

📊 Summary & Action Plan:

🔼 Above 55,835: Bullish continuation zone → Target 56,000 – 56,200

🔄 Between 55,300 – 55,500: Neutral zone → Wait for breakout or breakdown

🔽 Below 55,026: Bearish sentiment → Watch for reversal at 54,709 or breakdown continuation

📌 Golden Rule: Let price show intent. Follow levels, not emotions. Never compromise on risk management.

📢 Disclaimer:

I am not a SEBI-registered analyst. The content above is purely for educational and informational purposes. Please do your own research or consult a registered financial advisor before taking any trading decisions.

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.

Aviso legal

As informações e publicações não devem ser e não constituem conselhos ou recomendações financeiras, de investimento, de negociação ou de qualquer outro tipo, fornecidas ou endossadas pela TradingView. Leia mais em Termos de uso.