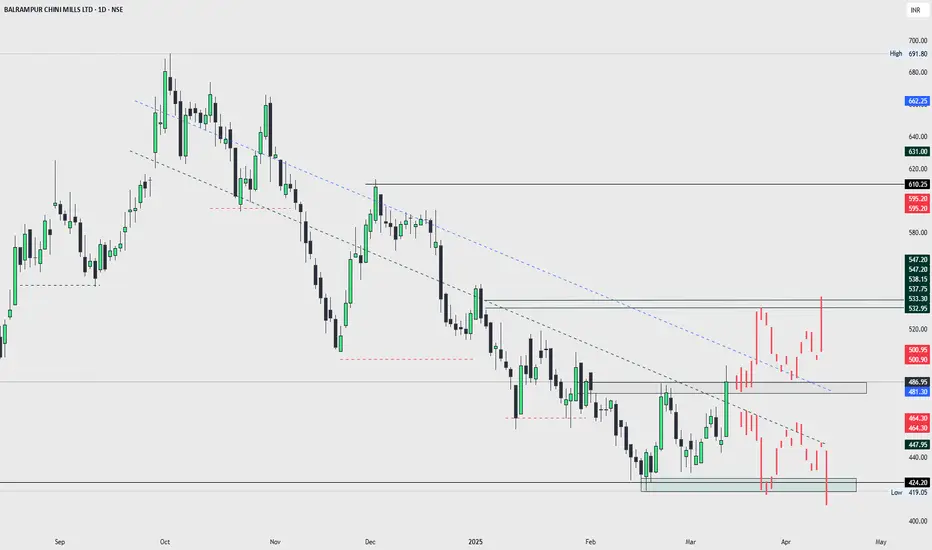

Balrampur Chini Mills Ltd | Breakout & Key Levels Analysis

The stock has been in a downtrend for the past few months, respecting a descending trendline. However, recent price action shows a strong breakout above key resistance levels, indicating potential bullish momentum.

Key Observations:

✅ Breakout Above Trendline: Price has broken past the descending resistance, signaling a possible trend reversal.

✅ Retesting Supply Zone (532-538): The price is currently testing a critical supply area. A strong close above this could confirm further upside.

✅ Supports to Watch: Immediate support around 486-481, followed by major demand at 424-419 if weakness persists.

✅ Resistance Levels: Next hurdle around 547-550 before a potential rally toward 595-610.

📉 If rejection occurs at resistance, expect a pullback to retest breakout levels.

📈 If sustained buying continues, price could move towards higher resistance zones.

Key Observations:

✅ Breakout Above Trendline: Price has broken past the descending resistance, signaling a possible trend reversal.

✅ Retesting Supply Zone (532-538): The price is currently testing a critical supply area. A strong close above this could confirm further upside.

✅ Supports to Watch: Immediate support around 486-481, followed by major demand at 424-419 if weakness persists.

✅ Resistance Levels: Next hurdle around 547-550 before a potential rally toward 595-610.

📉 If rejection occurs at resistance, expect a pullback to retest breakout levels.

📈 If sustained buying continues, price could move towards higher resistance zones.

Trade ativo

Stock has now given a breakout of 480 level, keep eye on that.Trade fechado: objetivo atingido

Stock has reached 536, and First Target completed, let's see and wait for the second target.Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.