OPEN-SOURCE SCRIPT

PowerZone Trading Strategy

Explanation of the PowerZone Trading Strategy for Your Users

The PowerZone Trading Strategy is an automated trading strategy that detects strong price movements (called "PowerZones") and generates signals to enter a long (buy) or short (sell) position, complete with predefined take profit and stop loss levels. Here’s how it works, step by step:

1. What is a PowerZone?

A "PowerZone" (PZ) is a zone on the chart where the price has shown a significant and consistent movement over a specific number of candles (bars). There are two types:

Bullish PowerZone (Bullish PZ): Occurs when the price rises consistently over several candles after an initial bearish candle.

Bearish PowerZone (Bearish PZ): Occurs when the price falls consistently over several candles after an initial bullish candle.

The code analyzes:

A set number of candles (e.g., 5, adjustable via "Periods").

A minimum percentage move (adjustable via "Min % Move for PowerZone") to qualify as a strong zone.

Whether to use the full candle range (highs and lows) or just open/close prices (toggle with "Use Full Range [High/Low]").

2. How Does It Detect PowerZones?

Bullish PowerZone:

Looks for an initial bearish candle (close below open).

Checks that the next candles (e.g., 5) are all bullish (close above open).

Ensures the total price movement exceeds the minimum percentage set.

Defines a range: from the high (or open) to the low of the initial candle.

Bearish PowerZone:

Looks for an initial bullish candle (close above open).

Checks that the next candles are all bearish (close below open).

Ensures the total price movement exceeds the minimum percentage.

Defines a range: from the high to the low (or close) of the initial candle.

These zones are drawn on the chart with lines: green or white for bullish, red or blue for bearish, depending on the color scheme ("DARK" or "BRIGHT").

3. When Does It Enter a Trade?

The strategy waits for a breakout from the PowerZone range to enter a trade:

Buy (Long): When the price breaks above the high of a Bullish PowerZone.

Sell (Short): When the price breaks below the low of a Bearish PowerZone.

The position size is set to 100% of available equity (adjustable in the code).

4. Take Profit and Stop Loss

Take Profit (TP): Calculated as a multiple (adjustable via "Take Profit Factor," default 1.5) of the PowerZone height. For example:

For a buy, TP = Entry price + (PZ height × 1.5).

For a sell, TP = Entry price - (PZ height × 1.5).

Stop Loss (SL): Calculated as a multiple (adjustable via "Stop Loss Factor," default 1.0) of the PZ height, placed below the range for buys or above for sells.

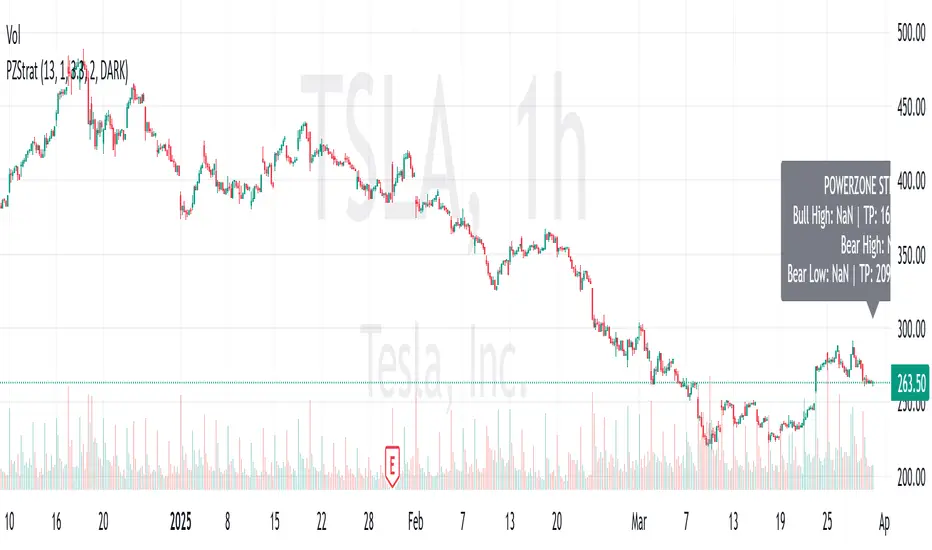

5. Visualization on the Chart

PowerZones are displayed with lines on the chart (you can hide them with "Show Bullish Channel" or "Show Bearish Channel").

An optional info panel ("Show Info Panel") displays key levels: PZ high and low, TP, and SL.

You can also enable brief documentation on the chart ("Show Documentation") explaining the basic rules.

6. Alerts

The code generates automatic alerts in TradingView:

For a bullish breakout: "Bullish PowerZone Breakout - LONG!"

For a bearish breakdown: "Bearish PowerZone Breakdown - SHORT!"

7. Customization

You can tweak:

The number of candles to detect a PZ ("Periods").

The minimum percentage move ("Min % Move").

Whether to use highs/lows or just open/close ("Use Full Range").

The TP and SL factors.

The color scheme and what elements to display on the chart.

Practical Example

Imagine you set "Periods = 5" and "Min % Move = 2%":

An initial bearish candle appears, followed by 5 consecutive bullish candles.

The total move exceeds 2%.

A Bullish PowerZone is drawn with a high and low.

If the price breaks above the high, you enter a long position with a TP 1.5 times the PZ height and an SL equal to the height below.

The system executes the trade and exits automatically at TP or SL.

Conclusion

This strategy is great for capturing strong price movements after consolidation or momentum zones. It’s automated, visual, and customizable, making it useful for both beginner and advanced traders. Try it out and adjust it to fit your trading style!

The PowerZone Trading Strategy is an automated trading strategy that detects strong price movements (called "PowerZones") and generates signals to enter a long (buy) or short (sell) position, complete with predefined take profit and stop loss levels. Here’s how it works, step by step:

1. What is a PowerZone?

A "PowerZone" (PZ) is a zone on the chart where the price has shown a significant and consistent movement over a specific number of candles (bars). There are two types:

Bullish PowerZone (Bullish PZ): Occurs when the price rises consistently over several candles after an initial bearish candle.

Bearish PowerZone (Bearish PZ): Occurs when the price falls consistently over several candles after an initial bullish candle.

The code analyzes:

A set number of candles (e.g., 5, adjustable via "Periods").

A minimum percentage move (adjustable via "Min % Move for PowerZone") to qualify as a strong zone.

Whether to use the full candle range (highs and lows) or just open/close prices (toggle with "Use Full Range [High/Low]").

2. How Does It Detect PowerZones?

Bullish PowerZone:

Looks for an initial bearish candle (close below open).

Checks that the next candles (e.g., 5) are all bullish (close above open).

Ensures the total price movement exceeds the minimum percentage set.

Defines a range: from the high (or open) to the low of the initial candle.

Bearish PowerZone:

Looks for an initial bullish candle (close above open).

Checks that the next candles are all bearish (close below open).

Ensures the total price movement exceeds the minimum percentage.

Defines a range: from the high to the low (or close) of the initial candle.

These zones are drawn on the chart with lines: green or white for bullish, red or blue for bearish, depending on the color scheme ("DARK" or "BRIGHT").

3. When Does It Enter a Trade?

The strategy waits for a breakout from the PowerZone range to enter a trade:

Buy (Long): When the price breaks above the high of a Bullish PowerZone.

Sell (Short): When the price breaks below the low of a Bearish PowerZone.

The position size is set to 100% of available equity (adjustable in the code).

4. Take Profit and Stop Loss

Take Profit (TP): Calculated as a multiple (adjustable via "Take Profit Factor," default 1.5) of the PowerZone height. For example:

For a buy, TP = Entry price + (PZ height × 1.5).

For a sell, TP = Entry price - (PZ height × 1.5).

Stop Loss (SL): Calculated as a multiple (adjustable via "Stop Loss Factor," default 1.0) of the PZ height, placed below the range for buys or above for sells.

5. Visualization on the Chart

PowerZones are displayed with lines on the chart (you can hide them with "Show Bullish Channel" or "Show Bearish Channel").

An optional info panel ("Show Info Panel") displays key levels: PZ high and low, TP, and SL.

You can also enable brief documentation on the chart ("Show Documentation") explaining the basic rules.

6. Alerts

The code generates automatic alerts in TradingView:

For a bullish breakout: "Bullish PowerZone Breakout - LONG!"

For a bearish breakdown: "Bearish PowerZone Breakdown - SHORT!"

7. Customization

You can tweak:

The number of candles to detect a PZ ("Periods").

The minimum percentage move ("Min % Move").

Whether to use highs/lows or just open/close ("Use Full Range").

The TP and SL factors.

The color scheme and what elements to display on the chart.

Practical Example

Imagine you set "Periods = 5" and "Min % Move = 2%":

An initial bearish candle appears, followed by 5 consecutive bullish candles.

The total move exceeds 2%.

A Bullish PowerZone is drawn with a high and low.

If the price breaks above the high, you enter a long position with a TP 1.5 times the PZ height and an SL equal to the height below.

The system executes the trade and exits automatically at TP or SL.

Conclusion

This strategy is great for capturing strong price movements after consolidation or momentum zones. It’s automated, visual, and customizable, making it useful for both beginner and advanced traders. Try it out and adjust it to fit your trading style!

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Join my trading community on Discord! 📈 Use all our indicators for FREE

discord.gg/xPEDcNEupw

discord.gg/xPEDcNEupw

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Script de código aberto

Em verdadeiro espírito do TradingView, o criador deste script o tornou de código aberto, para que os traders possam revisar e verificar sua funcionalidade. Parabéns ao autor! Embora você possa usá-lo gratuitamente, lembre-se de que a republicação do código está sujeita às nossas Regras da Casa.

Join my trading community on Discord! 📈 Use all our indicators for FREE

discord.gg/xPEDcNEupw

discord.gg/xPEDcNEupw

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.