This method am about to explain to you has been tested & battle proofed, it is the same trading method touch at Trading schools academies & is how the pro traders trade/use. It if followed it would yield 65 to 75 probability in your favor on charts with day or smaller timeframes and a 75 to 90 probability on swing trades especially in week timeframe. Am sharing it from the goodness of my heart & selfishly motivated to reach more probability score if more people trade like this.. this will be more of a self fulfilling prophecy..

identify the Longterm trend.

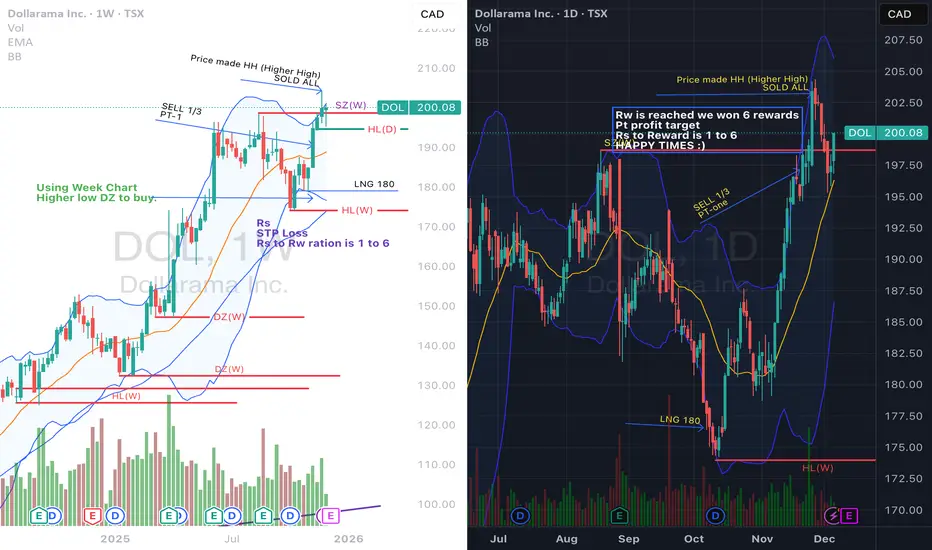

After identifying the longterm trend & identifying the last HL (higher Low) of the uptrend. but a line on that, this is your DZ (demand zone) this is the area you want to buy, you wait like a sniper & once price is there yo buy

Identify your Risk

calculated your risk before you calculated your reward. in other words identify how much you are willing to risk in money $ before you get out, or your stop limit order is triggered. you are out you had a Small Loss, you can handle it. This is your STP Loss price

When to sell & claim profit Rw (Reward, profit)

Identify your Pt (profit Target)s,this part I will save later, and reveal only when we have 1000 Likes - followers

Risk to Reward Ratio

This is important, it deserves its own section. Rs is your (Risk) and Rw is your (Reward). The correct reward ratio is 1 to 6 meaning you are willing to Risk 1 dollar for each 6 dollars you profit. Any trades with lower ratio is more risky & can be taken at trader own discretion. for example a low score of 1 to 3 yields less profit & more aggressive risk habitat.

here is an example

identify the Longterm trend.

After identifying the longterm trend & identifying the last HL (higher Low) of the uptrend. but a line on that, this is your DZ (demand zone) this is the area you want to buy, you wait like a sniper & once price is there yo buy

Identify your Risk

calculated your risk before you calculated your reward. in other words identify how much you are willing to risk in money $ before you get out, or your stop limit order is triggered. you are out you had a Small Loss, you can handle it. This is your STP Loss price

When to sell & claim profit Rw (Reward, profit)

Identify your Pt (profit Target)s,this part I will save later, and reveal only when we have 1000 Likes - followers

Risk to Reward Ratio

This is important, it deserves its own section. Rs is your (Risk) and Rw is your (Reward). The correct reward ratio is 1 to 6 meaning you are willing to Risk 1 dollar for each 6 dollars you profit. Any trades with lower ratio is more risky & can be taken at trader own discretion. for example a low score of 1 to 3 yields less profit & more aggressive risk habitat.

here is an example

Trade ativo

This method am about to explain to you has been tested & battle proofed, it is the same trading method taught at Trading school academies & is how the pro traders trade. if followed it would yield 65 to 75 probability in your favor on charts with day or smaller timeframes and a 75 to 90 probability on swing trades especially in week timeframe. Am sharing it from the goodness of my heart & selfishly motivated to reach more probability score if more people trade like this.. this will be more of a self fulfilling prophecy..identify the Longterm trend.

After identifying the longterm trend & identifying the last HL (higher Low) of the uptrend. put a line on that! this is your DZ (demand zone) this is the area you want to buy, your buy order waits, dont chase. time your Entry using a smaller timeframe chart.

Identify your Risk

You should be calculating your risk before calculating your reward. in other words identify how much you are willing to risk (money $) before you get out. This is your STP Loss price-where your stop loss order is triggered. If your STP Loss is triggered, you are out! you had a Small Loss, you can handle it.

When to sell & claim profit Rw (Reward, profit)

Identify your Pt (Profit Target)s, this part I will save for later, and reveal only when we have 1000 Likes - followers

Risk to Reward Ratio

This is important, it deserves its own section. Rs is your (Risk) and Rw is your (Reward). The correct reward ratio is 1 to 6 meaning you are willing to Risk 1 dollar for each 6 dollars of reward-profit. Any trades with lower ratio is more risky & can be taken at the trader's own discretion. for example a low score of 1 to 3 yields less profit & more aggressive risk appetite.

here is an example

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.

Aviso legal

As informações e publicações não se destinam a ser, e não constituem, conselhos ou recomendações financeiras, de investimento, comerciais ou de outro tipo fornecidos ou endossados pela TradingView. Leia mais nos Termos de Uso.